With a handy map!

You’d feel bad for Microsoft were it not a globe-spanning, multi-trillion dollar Goliath. After chalking up win after win after win—approvals from national regulators in Saudi Arabia, Brazil, Japan, Serbia, South Africa, and Chile—in its quest to acquire Activision Blizzard, it’s washed up on similar rocky, regulatory shores that scuppered the Nvidia/ARM deal last year.

The US FTC is looking increasingly sceptical and the UK has already given the acquisition a flat (and surprising) ‘no,’ but they’re not the only ones with a say in how this goes. While Microsoft and Activision fight their appeal in the UK, the acquisition continues to face scrutiny by national regulators all over the world. Here’s how the deal’s faring in territories currently examining it. You can use the map below to get a quick, at-a-glance look at where the deal stands around the world (click each country for more details), or use the index system on the left to jump to the deal’s approvals, rejections, and maybes, with links to relevant information and stories.

The Big No

United Kingdom

(Image credit: Travelpix Ltd via Getty)

Microsoft and Activision were left to sputter denunciations when the UK market regulator handed down its unexpected rejection on April 26, 2023. Both companies have forecast economic doom for the UK and—to rub salt in a tender political wound—publicly remarked on how much easier it is for tech to do business in the EU at the moment.

Harsh words aside, Microsoft and Activision immediately promised to appeal to CMA’s decision, and have enlisted the aid of legal hotshots David Pannick KC and Daniel Beard KC to front their campaign. Experts are sceptical of their chances, though: The CMA has won 67% of appeals brought against it since 2010.

Of course, there are rumblings that Microsoft might just go ahead with the deal anyway, presumably cutting off some section of its UK business to make it all work in the process. But surely not, right? Right?

Microsoft filed its appeal at the end of May.

The Maybes

United States

(Image credit: Andrey Denisyuk via Getty)

The US Federal Trade Commission has been unequivocal in its hostility to the deal for a long time now. Back on December 8, 2022, the FTC announced it would seek to block the acquisition, alleging that the “maker of Xbox would gain control of top video game franchises, enabling it to harm competition in high-performance gaming consoles and subscription services by denying or degrading rivals’ access to its popular content”.

So why is this entry in the ‘Maybe’ section?

Well, it’s not over until an administrative law judge has had their say. The FTC’s challenge to the deal has to go through a bunch of legal wrangling before it can be approved or rejected. A hearing on the FTC’s case is set to kick off on August 2 this year. Even then, the verdict can be appealed to the FTC itself, and then the verdict on that appeal can itself be appealed to a US federal court.

So settle in for the long haul, basically. On top of all that, the FTC recently asked a federal district court to block Microsoft and Activision going ahead with the deal anyway—despite the block from the UK CMA—after reports began circulating that the two companies might press on even without UK approval (necessitating some kind of divestment from the UK market, a rather bold and spectacular move). The regulator was granted a temporary block while the court waited to hear a full case for a preliminary injunction starting on June 22. Even weirder? Microsoft welcomed the move, eager as it is to get its legal arguments in front of a federal court as soon as possible.

My head hurts.

Australia

(Image credit: Neal Pritchard Photography via Getty)

No one can accuse Australia of rushing. The Australian Competition and Consumer Commission has “suspended” its timeline for deciding on the Microsoft/Activision deal while it consults with regulators overseas. The deal has become the oldest outstanding issue on the regulator’s books while it puts it head together with other regulators (or, perhaps more accurately, while it waits to see what everyone else does before doing that too).

Of course, given that almost every regulator has approved or rejected the acquisition by now, you’ve gotta think it won’t be long before the ACCC emerges from its reverie and gets off the fence. Which side will it come down on? Well, I suppose it depends on which overseas regulators the ACCC consults with.

New Zealand

(Image credit: PA Thompson via Getty)

Like its Australian neighbour, the New Zealand Commerce Commission is taking its time reaching a conclusion on the Microsoft/Activision deal. Since kicking off proceedings in June 2022, the CC has stopped and restarted its administrative clock once and extended its deadline to reach a decision seven times. Hey, I’ve had essays due before too, CC, I feel you.

The CC’s current—and one has to imagine final, given that nearly everyone else has decided by now—deadline to reach a decision is July 17, 2023. There’s no word yet which way the regulator is leaning.

The Approvals

European Union

(Image credit: Westend61 via Getty)

European regulators thumbed their nose at the UK’s then-recent rejection of the Microsoft/Activision deal when they waved it through in mid-May. Microsoft’s spree of signing ten-year contracts with pretty much anyone who asks (Nintendo, Nvidia, a UK mobile network, some streaming platforms you’ve never heard of, and even Sony, who said no) seems to have convinced EU regulators that it can be trusted to act as a responsible shepherd for Activision’s thick catalogue of popular products.

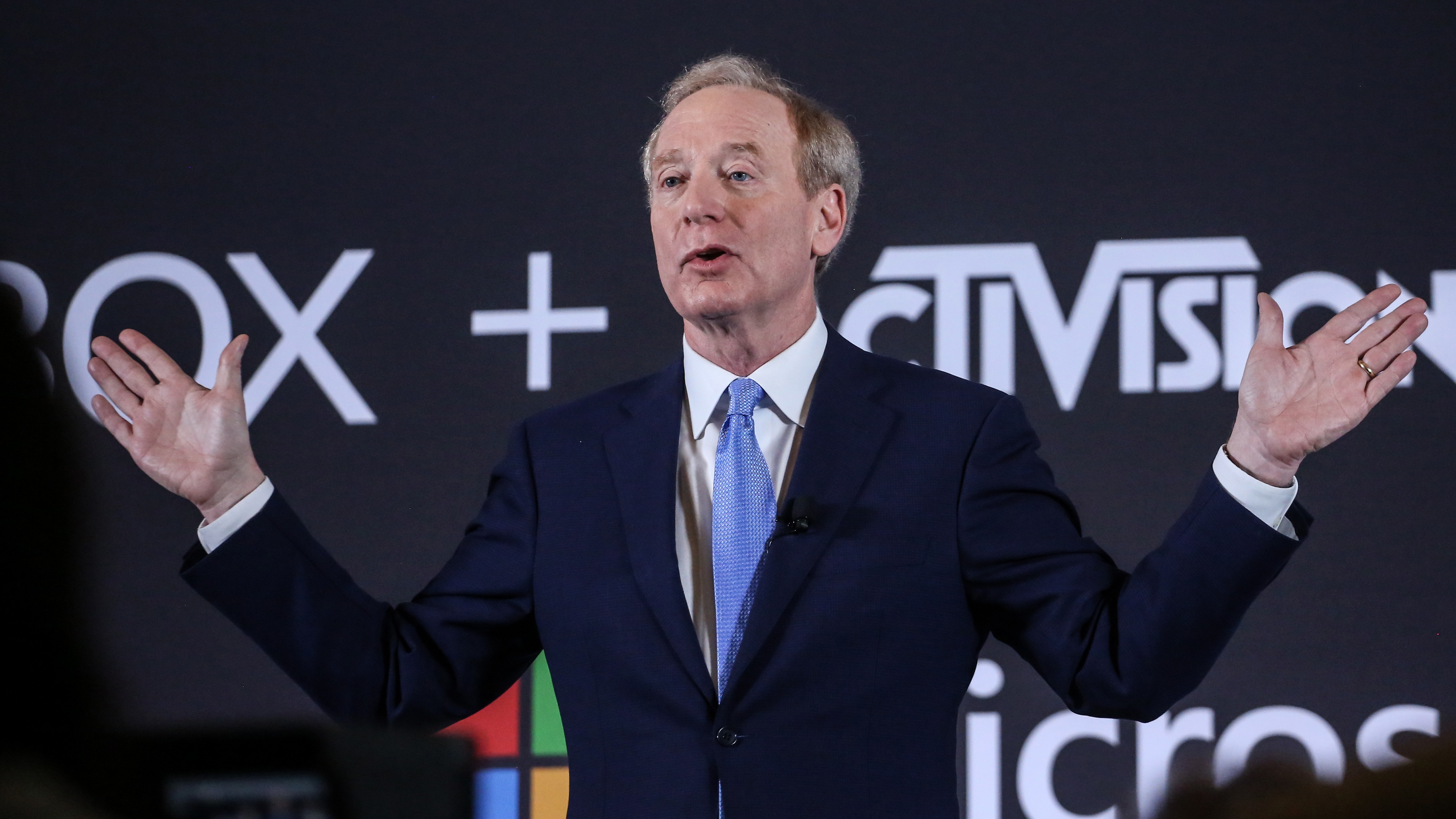

Brussels also no doubt quite enjoyed it when Microsoft president Brad Smith publicly said the EU was a much friendlier place to do business than the UK. Who said games aren’t political?

China

(Image credit: Toa55 via Getty)

China’s State Administration for Market Regulation probably made a few tech execs nervous in 2022, when it rejected Microsoft and Activision’s request to have the acquisition scrutinised according to a “simplified” procedure. It opted instead to use its normal procedure, thank you very much. Ominous!

Or not. The SAMR waved the deal through in May, a few months after Tencent—the country’s tech and gaming Goliath—was reported to have voiced its support for the merger. I guess not everyone in the country is as cross with Activision Blizzard as NetEase is.

South Korea

(Image credit: Stockbyte via Getty)

The Korean Fair Trade Commission approved Microsoft’s acquisition of Activision on May 30, 2023, at the conclusion of a process which was remarkably free of dramatic twists and turns. “The combined market share of games developed and distributed by Microsoft and Blizzard is small,” said the regulator, “and there are a number of popular game developers that competitors can deal with alternatively, so there is no possibility of foreclosure to exclude competing game service companies”.

Plus, even if Microsoft did try to throw its weight around, “the effect of converting competitors’ consumers to its service subscribers is minimal due to the low popularity of Blizzard’s games”.

While regulators like the UK CMA and US FTC (uh, no relation) have raised alarm bells about the merger’s possible anti-competitive effects, South Korea reckoned it might actually promote more console gaming competition in the country.

Saudi Arabia

(Image credit: FAYEZ NURELDINE (Getty Images))

Saudi Arabia’s approval of the Microsoft/Activision deal came lightning-fast. So quick, in fact, that the country’s General Authority for Competition was the first national regulator in the world to reach a decision on the deal.

But it makes sense. One of Saudi Arabia’s flagship schemes right now is its Vision 2030 plan: A strategy to reduce the country’s dependence on its absurdly large oil reserves through investments in things like tech and videogames. The country’s dreadful human rights record makes that a, uh, controversial scheme at best, but it’s one that Crown Prince Mohammed bin Salman continues to pour billions of dollars into. If the plan is gonna work, Saudi has to stay on the right side of the world’s tech titans. Such as, for example, Microsoft.

Brazil

(Image credit: Ingo Roesler via Getty)

Brazil was the second country in the world to approve the Activision acquisition after Saudi Arabia: The country’s Administrative Council for Economic Defence cleared it “without restriction” on October 5, 2022.

Its reasoning was interesting, and fairly brutal for old Sony. The PlayStation-maker’s arguments against the deal had mostly revolved around the possibility of losing access to Call of Duty, and CADE gave them short shrift. After all, it argued, COD wasn’t on Steam for years and still isn’t on Switch, and both of those platforms are doing gangbusters.

Even harsher, CADE accepted in theory that Microsoft acquiring Activision could harm Sony, it just didn’t care. It said its mission was “the protection of competition as a means of promoting the well-being of the Brazilian consumer,” and not “the defence of the particular interests of specific competitors” like Sony.

Japan

(Image credit: AlxeyPnferov via Getty)

The Japan Fair Trade Commission approved the Microsoft/Activision deal without fuss on March 28, 2023, concluding that “the transaction is unlikely to result in substantially restraining competition in any particular fields of trade” and therefore “the integration falls under the safe harbor criteria for vertical business combinations”. Well, that was easy.

Wisely, the JFTC also remarked that—since so much game distribution was done digitally these days—the merger would be very unlikely to cause a shortage in supply. Accurate!

Serbia

(Image credit: Sergio Amiti)

The thing about Serbia’s approval of the Activision acquisition is that there’s barely any info out there (at least in English) about it. In fact, news of it only spread after a Reuters report happened to mention the approval offhandedly at the end of an article about Microsoft offering concessions to EU regulators.

All we have is a single-page PDF from the country’s Commission for the Protection of Competition, and all that says is that, yup, Serbia has no issue with the deal going ahead.

Even more strangely, the letter is dated August 12, 2022, before even Saudi Arabia approved the merger. I’ve reached out to the Serbian CPC to ask for clarification on its reasoning and timing for the approval, and I’ll update this piece if I hear back.

South Africa

(Image credit: Jon Hicks via Getty)

South Africa gave its blessing to the acquisition on April 17, 2023, kind of. The way the country’s system works, its Competition Commission scrutinises a proposed merger and then makes a recommendation to its Competition Tribunal, which is set to actually make a ruling on June 21, 2023.

The Competition Commission recommended approving the deal, though, so barring some kind of dramatic courtroom upset, this one’s as good as approved already.

Chile

(Image credit: Leonardo Silveira via Getty)

Chile’s National Economic Prosecutor’s Office (or Fiscalía Nacional Económica) announced its approval of the Activision acquisition on December 29, 2022. It concluded that Microsoft’s acquisition of the company wouldn’t substantially reduce competition in the country’s gaming sector, and that Microsoft would be fairly unlikely to yank Call of Duty from other consoles.

But even if it were likely to, it might not matter that much. The FNE pointed out that COD just isn’t as relevant in Latin America as it is in other parts of the world, so Sony’s arguments based on access to it didn’t ring quite as loudly in the ears of the region’s regulators.

Ukraine

(Image credit: Ayhan Altun via Getty)

The Antimonopoly Committee of Ukraine gave its blessing to the Microsoft/Activision deal on April 27, 2023, one day after the UK CMA shocked everyone by coming down against the deal.

The AMCU reflected on the CMA’s decision in its own announcement. Microsoft and Activision, said the regulator, don’t really participate in cloud gaming activities in Ukraine, making the merger’s potential impact on the sector something of a moot point. A translation of its statement (from GI.biz) reads, “the reasons for the prohibition of concentration in Great Britain are not relevant for assessing its impact on the dynamics of competition in Ukraine”.