Chip makers probably won't pass on wafer cost savings immediately.

The fact that we’re in iffy economic times and demand for all manner of capitalist consumables is down is not news. But the specific fact of lower silicon wafer prices of late is novel. And it immediately has us hoping for cheaper actual chips.

The news comes from Taiwanese media outlet UDN (via HardwareLUXX) and relates specifically to the blank or raw silicon wafers from which chips are etched using advanced lithography processes.

Reportedly, prices of six and eight-inch wafers are down for the first time in three years, while 12-wafers are holding steady but expected also to fall shortly. It’s the larger 12-inch wafers that are used for the most advanced processes at the most important foundry of all, TSMC, and also by Intel.

Higher wafer prices have been part or the reason why chip prices have gone up so dramatically in the last few years. According to industry observers, TSMC’s prices for a finished wafer fully etched with chips has increased from $10,000 per wafer in 2018 for a 7nm wafer to $20,000 per wafer for its latest 3nm tech. In 2016, a 10nm TSMC wafer would have cost you just $6,000.

Of course, blank wafer prices are far from the only factor determining final chip prices. The latest multi-layer production nodes are far more complex and time consuming to process than earlier nodes. And yields are always absolutely critical in dictating individual component prices.

So, despite much lower demand driven by everything from the broader economic downturn, higher interest rates, inflation, the demise of cryptocurrency mining and a raft of further factors, cheaper blank wafers aren’t going to immediately translate into cheaper actual chips.

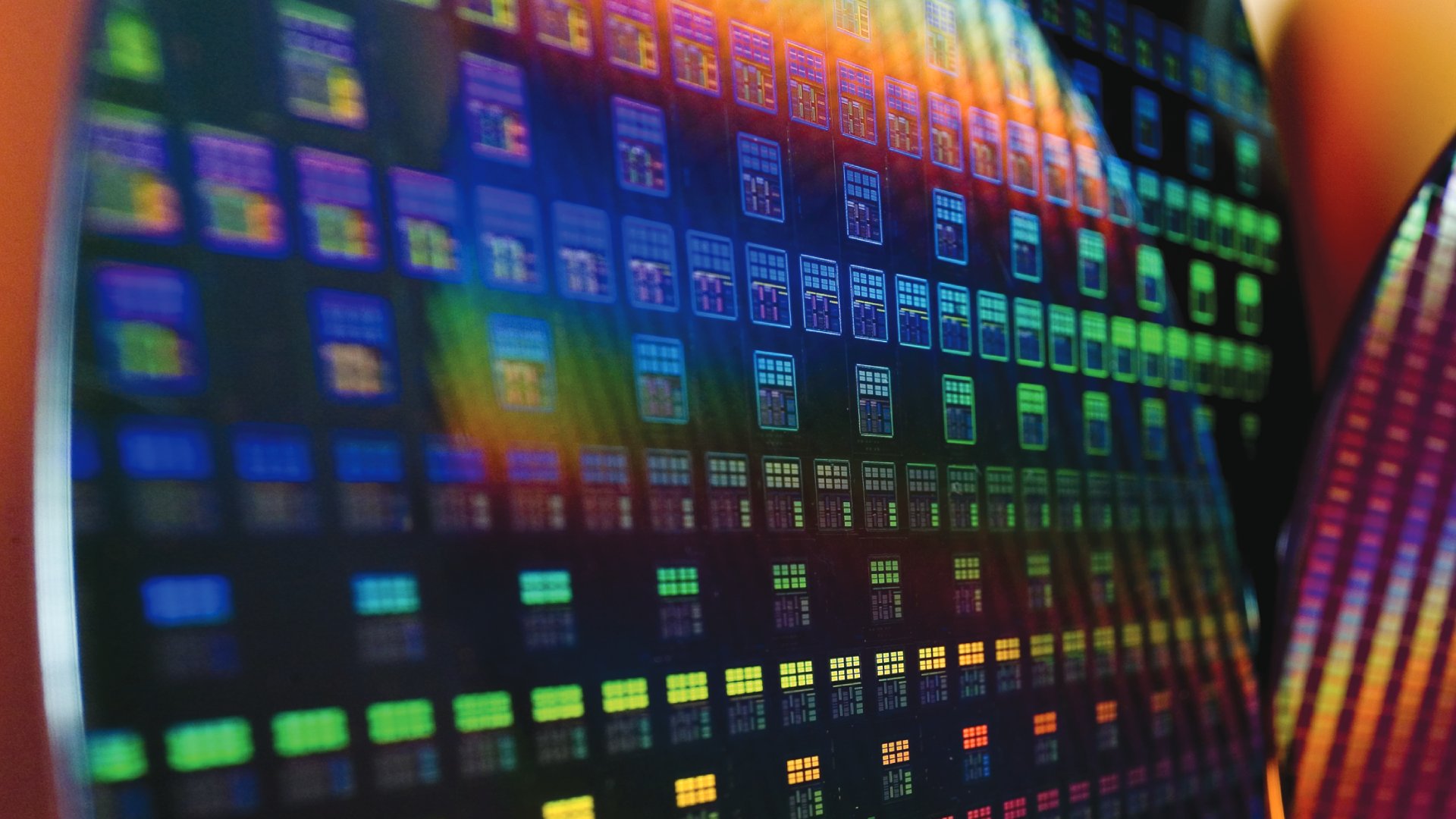

TSMC’s 3nm node has just begun production in Taiwan. (Image credit: TSMC)

(Image credit: Future)

Best CPU for gaming: The top chips from Intel and AMD

Best gaming motherboard: The right boards

Best graphics card: Your perfect pixel-pusher awaits

Best SSD for gaming: Get into the game ahead of the rest

Moreover, it can’t simply be assumed that the likes of TSMC will pass on lower blank wafer costs to customers like AMD and Nvidia. In which case, there would be no savings for those companies to pass on to long suffering gamers, even if they want to. And it’s highly questionable that they do.

Indeed, as we recently reported, AMD and other chip producers regularly adjust their chip output to prevent a glut of product and the lower prices that would ensue. The same applies to silicon wafers with UDN reporting that many chip foundries are having their wafer deliveries delayed and lowering their manufacturing volumes.

In the very long run, sustained lower demand will drag prices down. And GPU pricing has come off from its wildest pandemic and crypto-fuelled peak. But the mechanics of wafer pricing are just another insight into why chip prices and therefore the cost of things like graphics cards is likely to fall gently rather than suddenly nosedive.

We’re just going to have to be patient.