The Silver Lake investment firm portfolio companies deliver $252 billion of revenue annually.

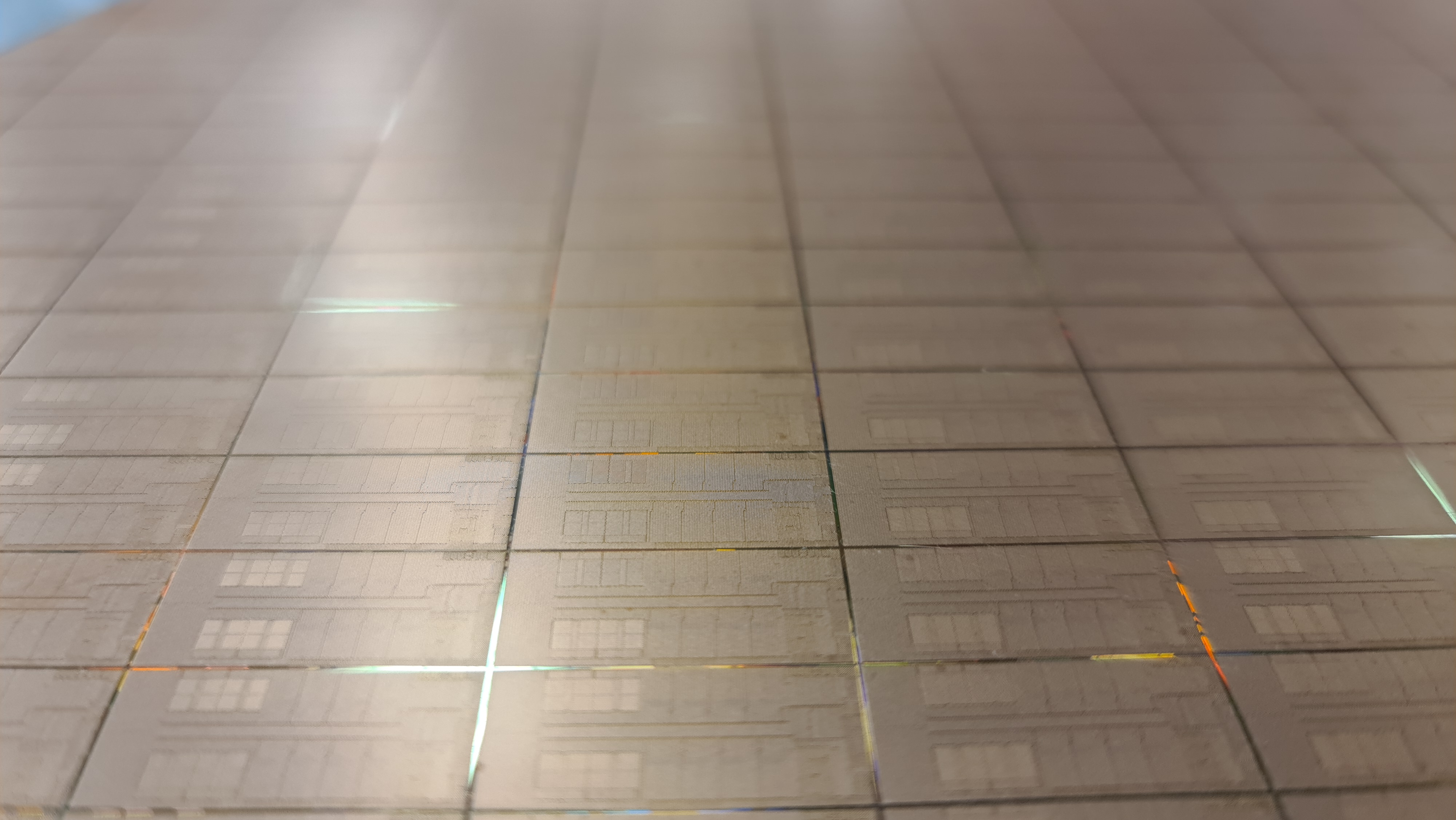

Intel has entered a deal to offload 51% of its stake in Altera, a specialised chipmaker focusing on programmable logic devices, to Silver Lake investment firm. Before it was owned by Intel, Altera and Intel worked together on several projects often using each other’s technologies. It wasn’t until 2015 when Intel acquired Altera for $16.7 billion. Since then, Altera has been seen as a division of Intel and one that’s responsible for FPGA’s or field programmable gate arrays with bespoke semiconductor solutions.

The trade values Altera at $8.75 billion, which seems like a bit of a step down from that 2015 price. Still, I wouldn’t be shaking my head at approximately four billion dollars for half a company, and Intel isn’t exactly giving it away. The company is making sure to retain the 49% share so it can continue to have a say in the development of the company.

The official statement claims Intel has made the sale to focus more on its core business.

We don’t yet know exactly what the figures will be for this sale, but it’s looking to be one of Silver Lake’s bigger investments in recent years. The firm itself is no stranger to pouring money into tech. A few of its more recent investments include tech and software companies, as well as some sports ones. Good to back both the nerds and jocks of the future. Other notable investments include Twitter and AirBnB both scoring $1 billion each back in 2020.

The similarity between Silver Lake and Intel’s chip naming scheme also appears to be an innocent coincidence. For a second I thought the firm might turn out to be a child company of Intel’s, but the two do seem sadly unrelated.

Still, Silver feels like a bit of a misnomer given the company boasts over $104 billion in investments which results in a portfolio of companies that turn over $252 billion of revenue annually. I could buy one million RTX 5090 cards at inflated pricies and still have change for that. Imagine how fast I’d be cracking malware…

The sale comes only a week after Intel announced Raghib Hussain, the former president of Products and Technologies at Marvell, was to replace Sandra Rivera as chief executive officer of Altera. This split of shares will also make Altera the largest technically independent company of its kind. Though time will tell how independent it ends up, and how much control Intel will still want to exercise with its remaining shares.

Best CPU for gaming: Top chips from Intel and AMD.

Best gaming motherboard: The right boards.

Best graphics card: Your perfect pixel-pusher awaits.

Best SSD for gaming: Get into the game first.