After briefly becoming the world's most valuable company Nvidia has now experienced the biggest three-day loss in value of any company ever.

It boggles the noggin that Nvidia can have posted the biggest ever loss in value for any company in the history of the world over the past three days, and that it will have precisely zero material impact on Jen-Hsun’s gang.

It makes sense after a stratospheric rise in market value, which briefly made Nvidia the most valuable company in the world, that there would be a correction, and that has happened over the past three days. It has now dropped in value by a combined total of 13%, which has effectively knocked over $500 billion off the stock.

Just over a year ago, at the end of January 2023, that sort of financial drop would have seen the company wiped out entirely, when its market capitalization was below the $500 billion mark. And yet here in June 2024 seeing that much wiped off the company’s value will hardly be noticed, such is the scale of the GPU giant today, with its current market cap at $2.9 trillion.

Considering that Nvidia is up just over 145% this year, and that over the past twelve months it’s up nearly 200%, you can probably see why a fall of 13% isn’t going to be a cause for concern within the green team. It’s probably still got just about enough cash to keep the lights on.

I mean, after all, the numbers bouncing around stock exchanges aren’t real things. The actual money coming in and going out of the company coffers hasn’t changed over those three days (well, it may well have continued to increase if the past few quarters of revenue figures are anything to go by), just the perception of the worth of the company in the financial sector has changed.

I’ve seen finance folk reporting the value drop as both a “bloodbath” and “an absolute slaughter for the AI company,” which honestly just seems a bit much.

But if anywhere is proof of the notion that perception is reality, the financial markets are probably it. Because of Nvidia’s slip that pushed the overall market down in turn, and that has led to some fears among analysts that the AI growth had turned into a bubble and was starting to go in the opposite direction.

We’re not there yet, with the noise around AI still very positive despite little tangibly positive coming from it. Well, apart from finally being able to create an image of a fish to share on social media whenever you want to sate that desire.

So, Nvidia is still going to sell a ton of GPUs into the AI industry—despite every company with a penchant for silicon desperate to build some sort of better and/or cheaper rival—and it will continue to make bank for so long as that continues. When/if the AI arms race ceases and demand for massive GPU data centers slackens, that might change. But that ain’t today.

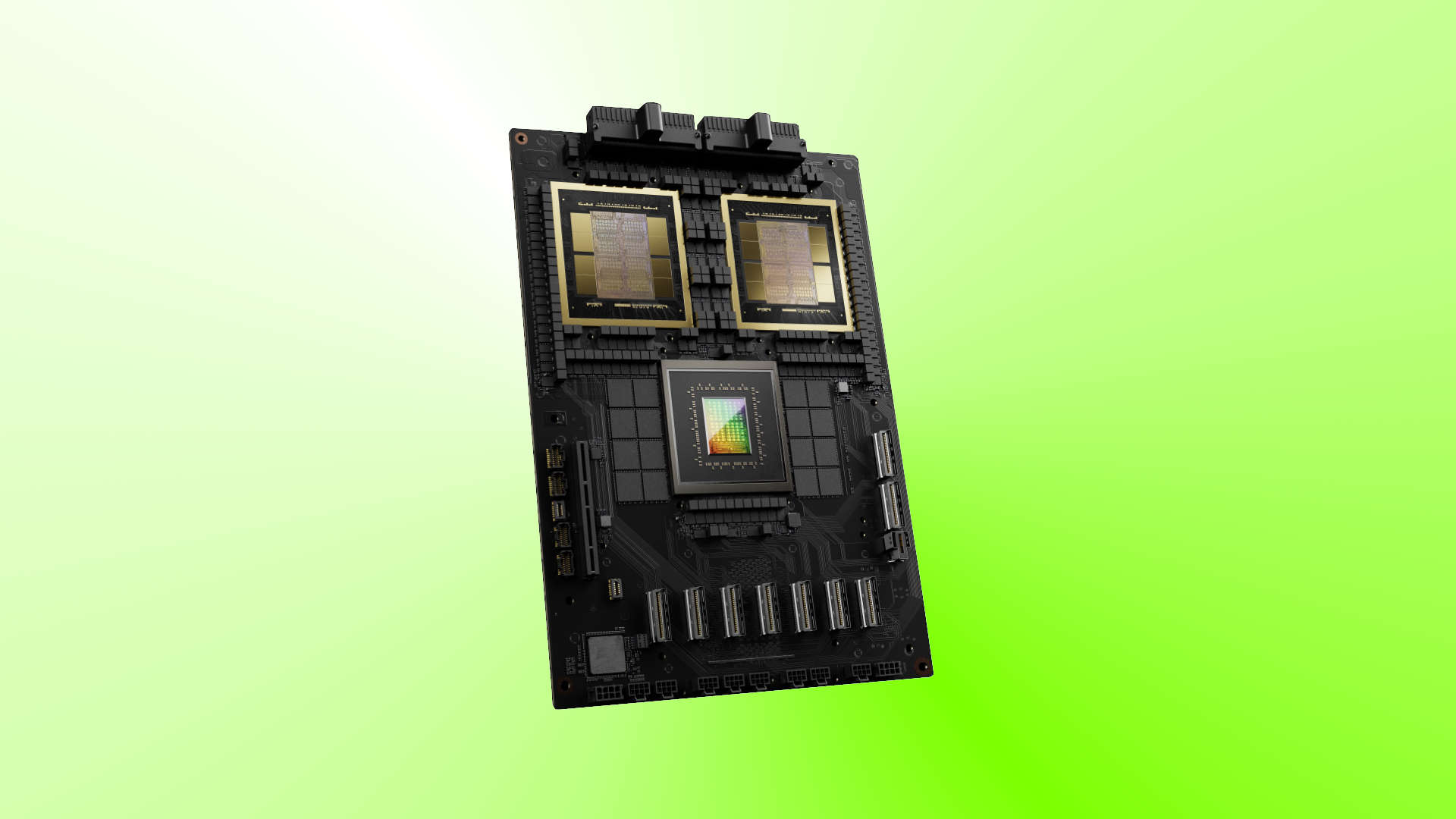

(Image credit: Future)

Best SSD for gaming: The best speedy storage today.

Best NVMe SSD: Compact M.2 drives.

Best external hard drives: Huge capacities for less.

Best external SSDs: Plug-in storage upgrades.

We still don’t know the impact that will have on PC gamers. Jen-Hsun told me specifically he still loves us gamers, that he couldn’t have done any of this without us, so fingers crossed the next generation of GeForce GPUs will be built and sold with love. I expect they’ll be significantly cheaper and much faster than the previous generation, because they don’t need that gamer cash anymore, right? Be a nice thank you, eh?

Of course, I jest. They’ll still be super ‘spensive.

But it’s not just Nvidia that has had a big ol’ correction, Bitcoin, too, has seen a hefty slide in its fortunes after another unfeasible rise in value. At this point I don’t see why there is any crypto market around at all. Seriously, what’s it for in 2024? Anyways, it’s dropped over 8% in value over the past week, going below $60,000 per coin for only the second time this year, after seeing a high of over $73,000 back in March.

Anyways, it’s another reminder that financial market darlings aren’t just one-way tickets to your first million. Stocks and crypto numbers can go down as well as up, remember.