China's new R1 AI model is putting the boots to Nvidia.

Nvidia is facing the biggest single-day market value loss in history, according to a report by Forbes, as the release of an open-source AI model called R1 by China-based DeepSeek has cut more than $600 billion from its valuation, knocking it off its perch as the world’s most valuable company.

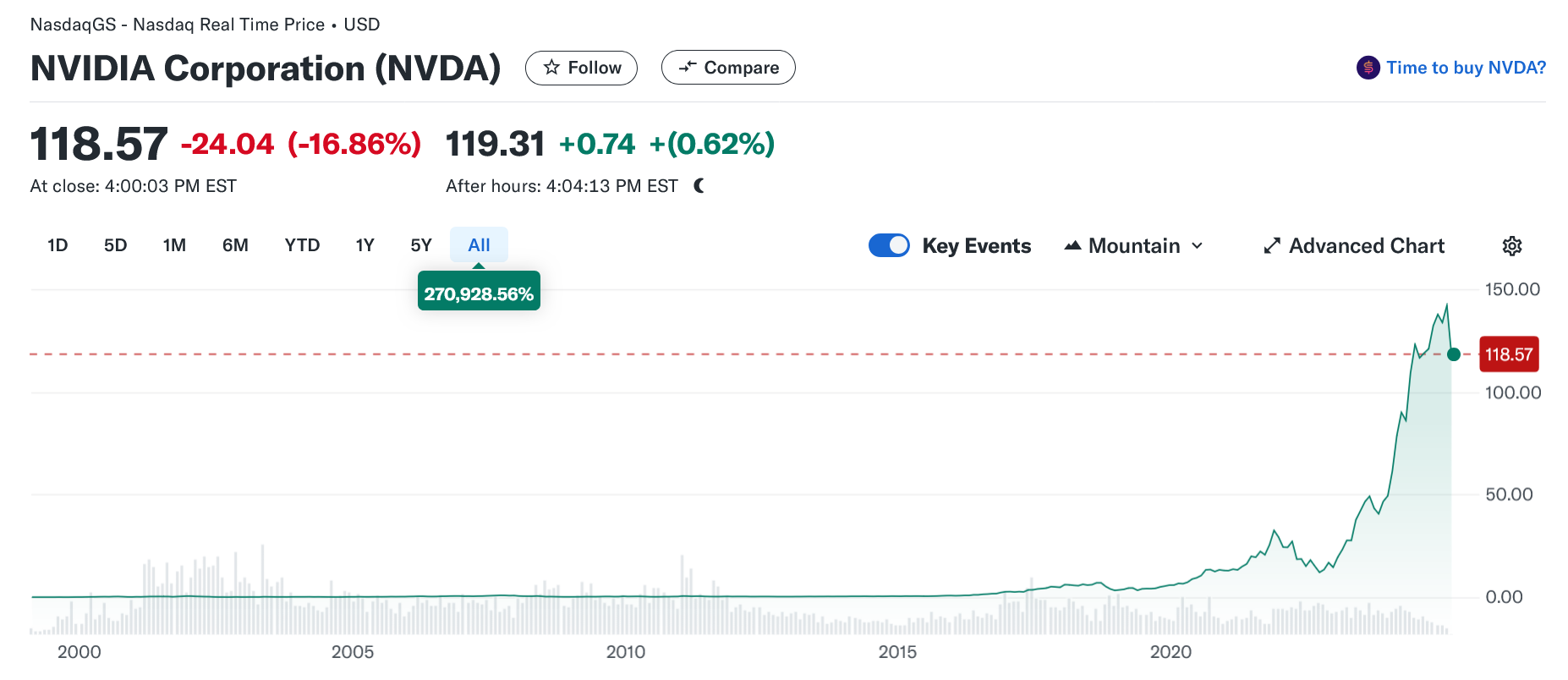

Nvidia’s share price dropped by more than 17% today as DeepSeek’s R1 model reportedly displayed capabilities comparable to more well-known names like OpenAI, but at a tiny fraction of the cost. While hundreds of billions of dollars are being poured into AI development in the West, DeepSeek claims it was able to achieve its remarkable results for less than $5.6 million—yes, million, not billion—which it attributed to “our optimized co-design of algorithms, frameworks, and hardware.”

This is a problem for Nvidia because while DeepSeek is still using Nvidia hardware to power its AI, the fact that it seemingly can do so much with so little naturally implies that other companies can do the same. If they all figure out the secret, it could drive a stake through the heart of demand for high-end (and extremely expensive) Nvidia GPUs that’s propelled the company’s share price over the past few years.

Forbes estimated that the personal net worth of Nvidia co-founder and CEO Jensen Huang also took a hit, dropping from $124.4 billion to $107.5 billion.

“The DeepSeek news is clearly likely to put pressure on semiconductor stocks today and perhaps in coming days, till there is more clarity on its potential impact on AI chip demand,” Jefferies analyst William Beavington wrote (via Barron’s).

Nvidia’s price is still way above where it was this time last year, but that’s one hell of a sharp decline.

Nvidia is the biggest and best-known of the companies to be hit by the R1 revelation, but it’s not the only one: A Financial Post report says the total valuation loss across US and European tech companies is set to exceed $1 trillion. As noted by the Canadian Press, Constellation Energy, the company planning to restart the Three Mile Island nuclear power plant in order to power Microsoft’s cloud and AI data centers, also got hammered in the fall, losing more than 20% of its value over the past few days.

Where this ultimately ends up remains to be seen. As Motley Fool noted, DeepSeek may be grossly underreporting the real costs of R1 development: One researcher quoted by the site said DeepSeek is probably spending closer to $500 million – $1 billion per year on the project—still much lower than US-based AI companies, but not as apocalyptic as the sub-$5.6 million figure—and in a recent CNBC interview, Scale AI CEO Alexander Wang said his “understanding” is that DeepSeek actually has access to about 50,000 Nvidia A100 Tensor Core GPUs, which it doesn’t talk about because US export controls means it’s not supposed to have them.

Others, however, think it’s the real deal. Tech writer Anil Dash, for one, wrote on Bluesky that even if R1’s gains in efficiency and cost reduction are overstated, they still represent a “huge leap” over OpenAI and other models.

I can’t shake the feeling that there’s something fundamentally wrong with a world in which half a trillion dollars (that really only existed on paper, but never mind that) can be wiped out because some rich people get nervous, but the good news for those of us who just want to use graphics cards to play videogames and not to take over the world is that Nvidia will probably be fine: Its share price is still astronomically higher than it was just a few years ago.