The AI boom goes hypersonic for some.

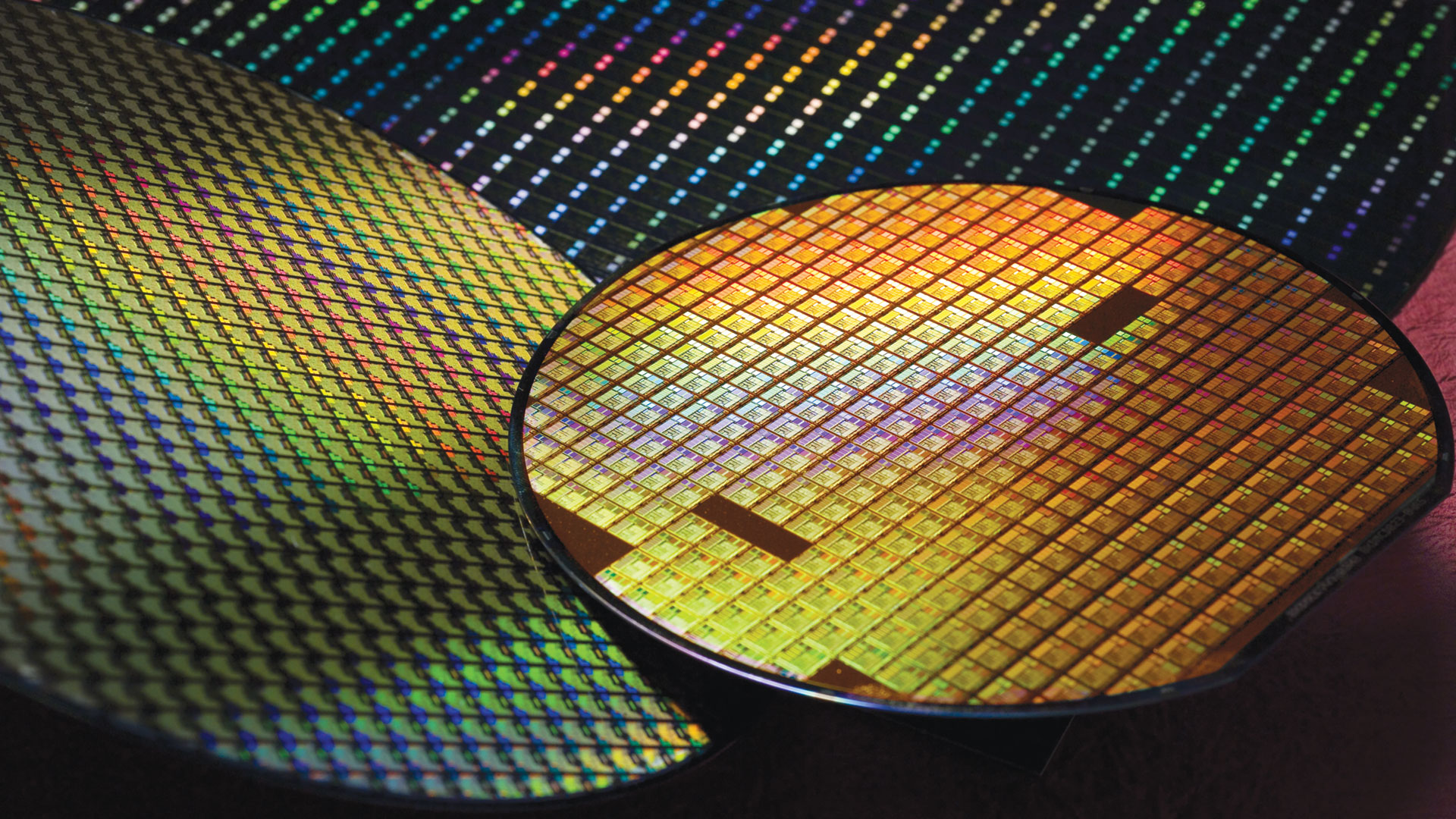

The AI hype-train has been rolling for some time now, and shows no signs of slowing down. While public perception of AI tech continues to vary, the semiconductor market looks to be booming as a result of all that investment, as the Semiconductor Industry Association (SIA) has announced that global semiconductor sales increased 23.2% in the third quarter of this year compared to the same period in 2023.

That equates to up to $166 billion worth of revenue, with a reported $55.3 billion in sales recorded in September alone (via Wccftech).

SIA President and CEO John Neuffer said: “The global semiconductor market continued to grow during the third quarter of 2024, with quarter-to-quarter sales increasing at the largest rate since 2016.

“Sales in September reached the market’s highest-ever monthly total, driven by a 46.3% year-to-year increase in the Americas.”

However, it’s not just the Americas seeing huge demand for high-end silicon. Year-to-year sales were also up in September for China by 22.9%, the Asia/Pacific region by 18.4%, and Japan by 7.7%. It wasn’t all steadily climbing lines though, as Europe’s sales dropped by 8.2% in the same month.

This tracks with the latest financial disclosures from TSMC, the worlds leading manufacturer of high-end chips. The Taiwanese company recently announced a third quarter revenue increase of 39% year-over-year, with third quarter revenue equating to $23.5 billion.

Certainly, Nvidia seems to be at the peak of the current semiconductor boom, as it’s once again overtaken Apple to sit top of the market cap table, with a current estimated value of $3.652 trillion. Demand for its new Blackwell enterprise GPUs has been immense, with industry titans like Amazon, Google, Microsoft and Oracle placing orders in the tens of thousands.

And that’s not to mention OpenAI, Meta and X. It seems like any large tech company worth knowing has been jumping on the Nvidia train, and it’s not like its previous generation Hopper H100 have been slow to sell, either. Meta has been buying the enterprise models en masse for some time now, and with proposed targets of 350,000 GPUs bought by the end of this year, that’s been estimated to work out to $7 billion’s worth of the older silicon purchased in total.

The cash is flowing, and the AI demand for high-end chips appears to be taking the semiconductor market to new heights. No boom lasts forever, of course, but these latest revenue figures show that it’s currently a very good time to be in the chip-making business for some.