That's surely going to ruffle some feathers.

Nvidia has both been the benefactor and victim of cryptocurrencies’ boom/bust cycle. When crypto was soaring in value, so was Nvidia’s share price. When crypto crashed, often Nvidia’s share price dropped with it. The company makes a product that was, for a long while, crucial to the operation of most of the world’s largest cryptocurrencies outside of bitcoin, and that’s been both a blessing and a curse.

Nvidia and crypto is a love/hate relationship. When the going was good, Nvidia would happily create entire product lines for the sole purpose of running algorithms to ‘mine’ cryptocurrency, known as CMP or Cryptocurrency Mining Processor. However, when crypto crashed, which it has a tendency to do, Nvidia would often be lumped with excess inventory of graphics cards and finding new ways to sell them.

Clearly Nvidia is in the hate stage of its relationship right now, as per recent comments to The Guardian by Nvidia’s CTO on the value of cryptocurrency to society.

“All this crypto stuff, it needed parallel processing, and [Nvidia] is the best, so people just programmed it to use for this purpose. They bought a lot of stuff, and then eventually it collapsed, because it doesn’t bring anything useful for society. AI does,” Nvidia CTO Michael Kagan said.

It’s no surprise that Nvidia is keen to position itself as the pre-eminent AI company, but I hadn’t expected the company to outright slam cryptocurrency in the process. Kagan’s comments touch on a debate that’s been raging for a while, however, and that’s whether cryptocurrency is a worthy alternative to fiat money or moreso a tool for generating profit. So far, we’ve seen a lot of examples of the latter, and not so many proving the former.

“I never believed that [crypto] is something that will do something good for humanity,” Kagan continued. “You know, people do crazy things, but they buy your stuff, you sell them stuff. But you don’t redirect the company to support whatever it is.”

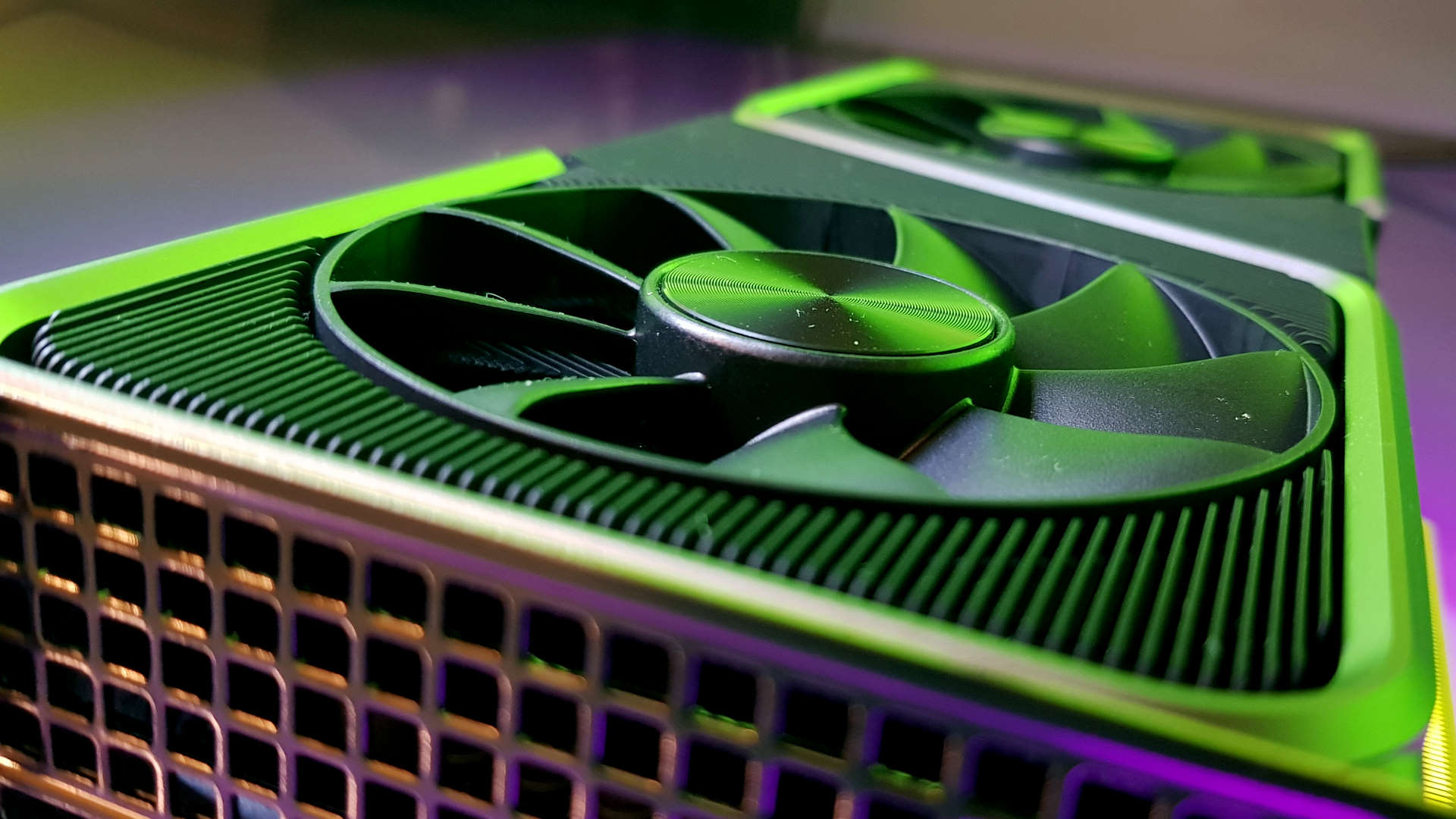

Nvidia created an entire line-up of cards dedicated to cryptocurrency mining in 2021. (Image credit: Nvidia)

Nvidia was prone to downplaying the role cryptocurrency played on the increased demand we saw for graphics cards over the past few years, which combined with supply chain issues led to graphics card shortages worldwide. Nvidia even attempted to block cryptocurrency mining on its GeForce GPUs, though this wasn’t said to be a very effective anti-mining measure.

Cryptocurrency mining is no longer one of the primary drivers of GPU sales, however, and could possibly stay that way for good.

(Image credit: Future)

Best CPU for gaming: The top chips from Intel and AMD

Best gaming motherboard: The right boards

Best graphics card: Your perfect pixel-pusher awaits

Best SSD for gaming: Get into the game ahead of the rest

Ethereum was the main cryptocurrency driving demand for graphics cards over the past few years and the crypto boom prior to that, which occurred around 2017/18. For both booms, Ethereum relied on a Proof-of-Work concept, which required massive computational power driven by graphics cards to mine Ether, the currency of the platform. Since September 2022, Ethereum uses a Proof-of-Stake concept, which no longer requires graphics cards to operate.

So far, no other cryptocurrency has grown enough to drive such high demand for graphics cards again. It’s possible that could happen, but we’re yet to see it. For the environment’s sake let’s hope we don’t.

Meanwhile people are clamouring to get their hands on Nvidia GPUs for uses with AI applications. Nvidia powers many of today’s most popular AI applications, including OpenAI’s ChatGPT and Stable Diffusion, and more are getting onboard. Over at GTC, the company’s developer conference, it was announced that Oracle, Meta, Amazon and Microsoft had recently invested in Nvidia’s H100 GPUs to “address rapidly growing demand for generative AI training and inference.”

All of which sounds like Nvidia’s looking to move on from crypto in a big way.